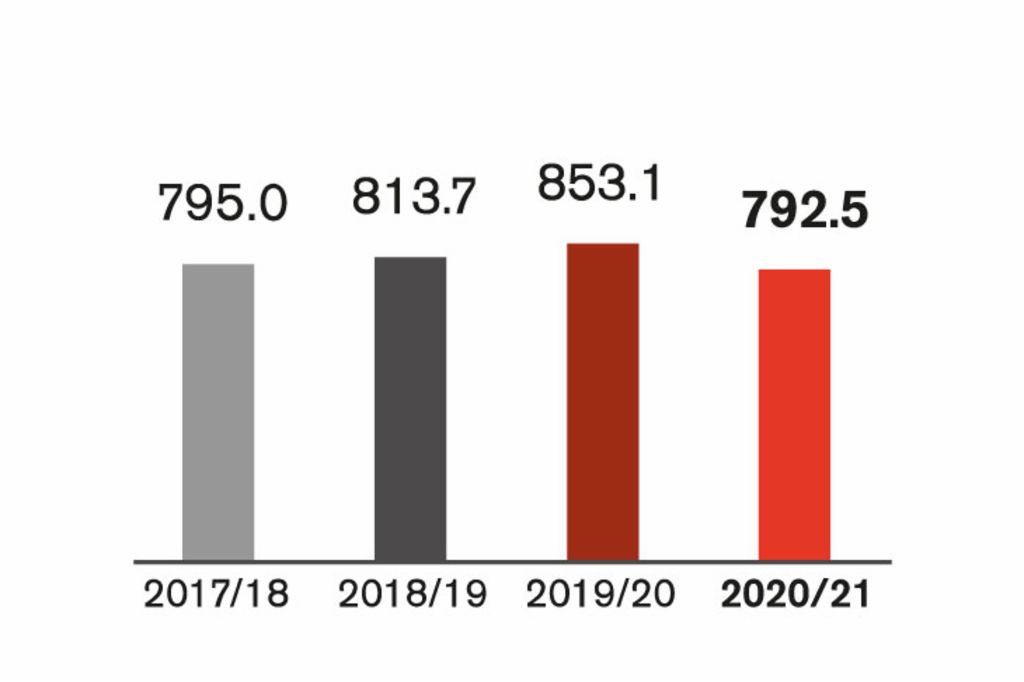

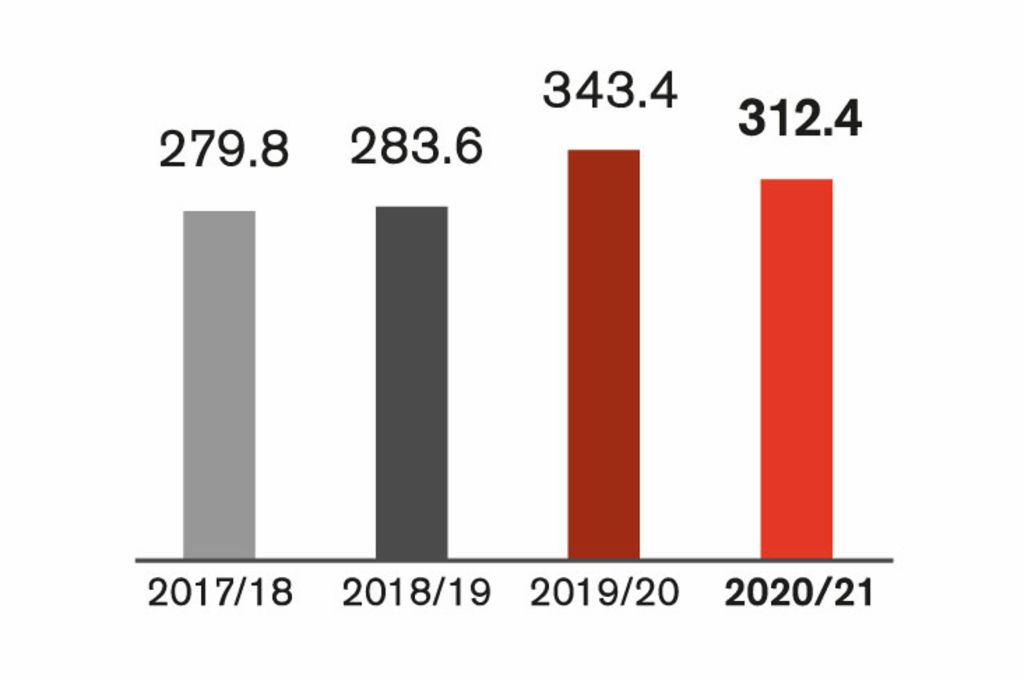

The revenue of EOS Consolidated for the 2020/21 financial year by individual region:Results in the regionsIn this financial year Germany is once again the region with the highest turnover within EOS Consolidated. Overall, each region recorded a decline as the result of the widespread consequences of the pandemic. Moratoriums and uncertainty in the markets caused a temporary reduction in the volume of non-performing loans and a corresponding decline in investment. Nevertheless, some countries, primarily in Western and Eastern Europe, were able to achieve positive results. For example, Spain reported record investments especially in the second half of the year. Moreover, the previous year’s investment level was exceeded in some Eastern European countries, especially in Russia and Poland.